How Long Will Us Airlines’ Cash Last? It Depends on the Carrier

KEY POINTS:

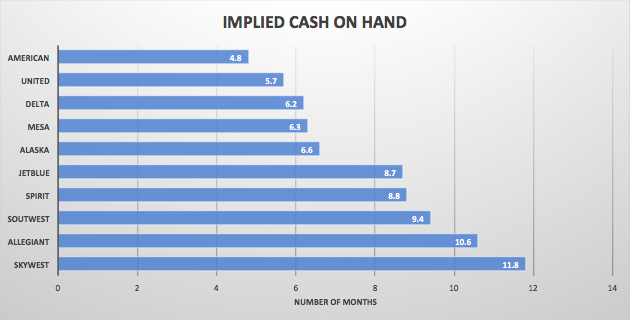

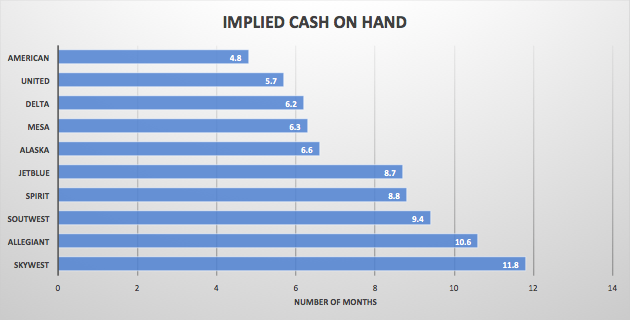

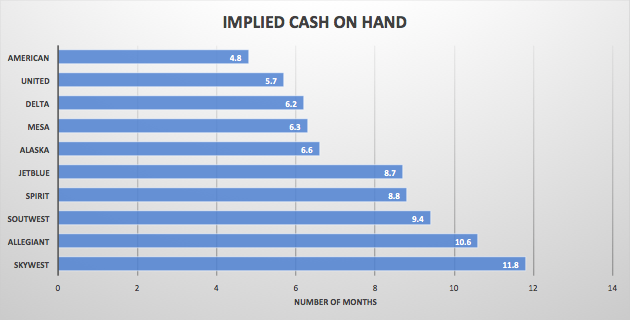

- The industry has enough cash to cover its bills for an average of 7.9 months, the report on April 5 finds.

- The analysis finds that American Airlines only has enough cash to cover only about 4.8 months of expenses while regional SkyWest Airlines has cash to cover nearly a year.

- "...why [are] many airlines, to the annoyance of numerous travelers, are issuing certificates for the value of cancelled trips rather than offering refunds. The goal is to hold onto as much as cash as possible."

- American has $12.4 billion in debt payments and other obligations due this year for things such as aircraft lease payments, according to its 2019 annual report. This equals just over $1 billion in fixed expenses monthly.

- “The margin for error for American management to navigate this crisis outside of the courts is growing uncomfortably thin,” wrote J.P. Morgan analyst Jamie Baker in a report on Monday.

- Analysts expect a smaller industry when things come back. Several Wall Street estimates put the number of travelers flying in 2021 at roughly four-fifths the number in 2019 — or back to about 2013 passenger levels.

>> Click here to read the entire article written by Edward Russell of The Points Guy

Dimon: Us Heading Into ‘Bad Recession’ With Financial Threats Akin to 2008

KEY POINTS:

- Dimon warned that the U.S financial system would face levels of stress akin to the 2007-08 crisis that derailed the global economy.

- “We don't know exactly what the future will hold,” Dimon wrote, “but at a minimum, we assume that it will include a bad recession combined with some kind of financial stress similar to the global financial crisis of 2008. Our bank cannot be immune to the effects of this kind of stress.”

- The U.S. lost 701,000 jobs in March, according to the monthly employment report released Friday by the Labor Department, though the survey captured but a sliver of the total economic damage.

- More than 10 million Americans have applied for unemployment benefits in the final two weeks of March, shattering records for weekly jobless claims and prompting fears of Great Depression-level devastation.

- “If we had a timely unemployment statistic, the unemployment rate probably would be up to 12 or 13 percent at this point and moving higher,” Former Federal Reserve Chairwoman Janet Yellen

>> Click here to read the entire article written by Sylvan Lane at The Hill

Warren Buffett sells airline stocks in an abrupt reversal

KEY POINTS:

- Delta on Friday said it is currently burning through more than $400 million of its cash reserve each week and expects second quarter revenue to fall 90% year over year.

- The hope is that as the pandemic is eventually contained passenger traffic will come back, but that's no sure bet if the economy falls into a recession. With each passing week, and with jobless claims reaching record highs, a recession seems more and more certain. And the airline industry's future gets less and less clear.

- Berkshire Hathaway's sale if nothing else could be interpreted as a sign that the brain trust in Omaha is worried we are headed into a severe downturn. If you believe there is a real chance of a quick rebound these airlines are significantly undervalued

- Selling after a sharp decline seems out of character for an investor who famously said, "be greedy when others are fearful."

- Investing in an airline today feels like a binary option: If the companies survive, the stocks as noted above are almost certainly undervalued. But there is a risk the economy doesn't recover in time and all the stocks are going to zero.

- Delta and Southwest, the two airlines we know Berkshire was selling, are the best run and have two of the strongest balance sheets in the industry. Bailing on those two in particular doesn't speak well for Berkshire Hathaway's overall view of the industry or the economy.

- Warren Buffett's initial turnaround from airline avoider to investor was hailed as a fresh start for the industry, and this latest U-turn is certainly a setback. But this journey isn't over yet.

>> Click here to read the entire article written by Lou Whiteman at The Motley Fool

Delta Air Lines, Pilots Spar Over Cost Savings as Revenues Plummet

KEY POINTS:

- Delta Air Lines and its pilots union are at odds over how to achieve needed cost reductions as the number of people flying in the U.S. and around the world hits record lows during the novel coronavirus pandemic.

- The Atlanta-based carrier wants to reduce the average flying time it must provide pilots by about 20% to cut costs in May and June.The Air Line Pilots Association says the airline could achieve more savings by offering cockpit crews additional voluntary paid leave.

- Delta is burning through roughly $60 million in cash daily as revenues have fallen by about 97% to $4 million a day. Daily revenues at United Airlines are down by $100 million.

- Funds from the $25 billion in compensation grants from the $2 trillion CARES Act allow airlines to maintain payrolls and wage rates until the end of September. After that, the companies and their unions will have to find ways to reduce costs in the face of what will likely be a long and slow recovery.

- “No department, no workgroup at any airline is sacred in this crisis,” Henry Harteveldt, founder of travel consultancy Atmosphere Research, said in an interview. “Everyone is going to have to accept that there is shared sacrifice by all.”

- “No other pilot group has been asked for concessions similar to what Delta management proposed, but virtually all other pilot groups are currently engaged in programs similar to what was offered by [the union],” the ALPA chapter at Delta told pilots in a contract negotiations update on Friday shared with TPG.

- Every airline and labor group will have to reach for some cost savings to weather the crisis — even ones with worse relations than between ALPA and Delta.“The virus is affecting all of us and it’s not the pilots or Delta’s fault,” said Harteveldt. “[They] have to accept that there will be some kind of compromise.”

>> Click here to read the entire article written by Edward Russell at The Points Guy

Additional Resources

How Does the Coronavirus Compare to 9/11?

How to Survive Disruptive Change

Are Furloughs Coming?

What Should Pilots Do In These Uncertain Times?

James Onieal & Jason DuVernay

:

Apr 8, 2020 10:00:49 AM